Management of sales taxes

The maintenance of the sales taxes is done easily with PRIM, you can add or modify a tax group according to the needs of your company.

In the menu ''System'', click on ![]() (Tax) in the section ''Configuration'' to open the ''Sales tax maintenance'' window.

(Tax) in the section ''Configuration'' to open the ''Sales tax maintenance'' window.

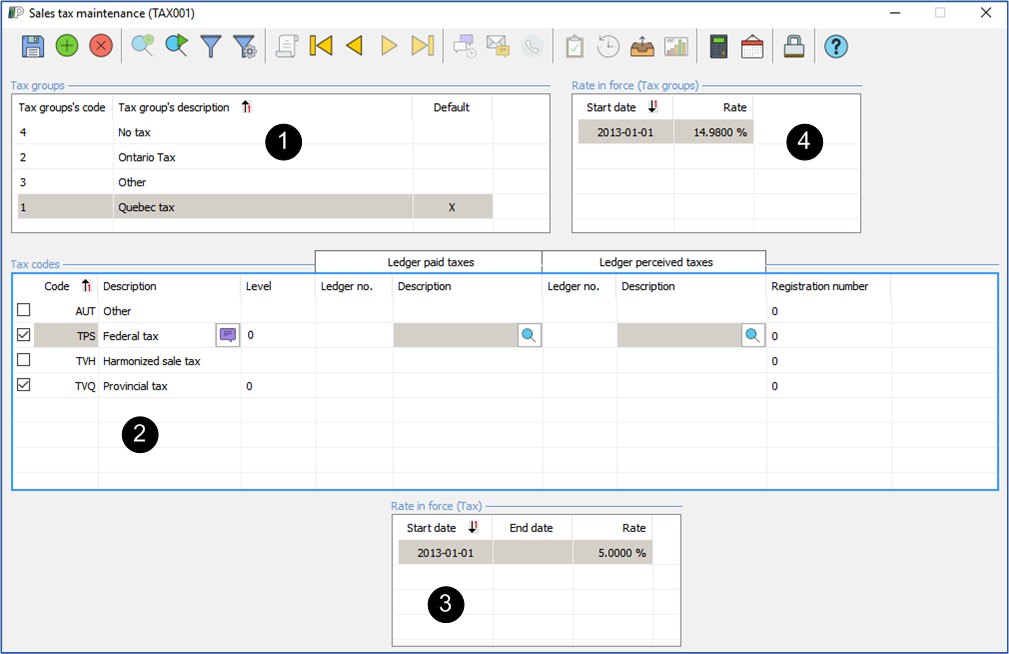

Tax codes: Single code of 3 characters for each tax used in your transactions.

Tax group: Contains one or more tax codes, it is added in the file of your clients and is editable according to your needs.

1.Section - Tax groups

•Click on a blank line to add a new record.

•Enter the description of this new group, the code will be automatically registered when you will save.

•Check the box ''Default'' if this tax group will be used for the majority of your transactions.

•Click on ![]() (Save).

(Save).

•To change the description of a tax group, select a group, click on the icon ![]() (Translation). Modify the text and the translation, if needed.

(Translation). Modify the text and the translation, if needed.

•Click on ![]() (Save).

(Save).

2.Section - Tax codes

•Click on a blank line to add a new record.

•Enter the code and the description of this code.

•Enter the registration number in this section if the divisions of your company have the same sales tax registration number.

•For each of the tax groups, check the tax codes which will be related to the selected group.

•Click on ![]() (Save).

(Save).

•To change the description of a tax code, select a code, click on the icon ![]() (Translation). Modify the text and the translation, if needed.

(Translation). Modify the text and the translation, if needed.

•To change the registration number, select a code and make the changes directly in the column ''Registration number''.

•Click on ![]() (Save).

(Save).

3.Section - Rate in force (Tax)

•Select a tax code, you have to register a rate for each of the codes related to a group.

•Click on a blank line, enter the new rate and the date on which this new rate will be in force. The end date of the old rate will be registered when you save.

•Click on ![]() (Save).

(Save).

4.Section - Rate in force (Tax groups)

•The rate displayed in this section is the total of the tax codes related to the selected group, it is calculated by PRIM.

•It will be added or modified automatically after an addition or a change of the rates in the section ''Rate in force (Tax)''.

![]() In the section ''Rate in force (Tax)'', you can change the current rate, but it is preferable to add another one to keep an history.

In the section ''Rate in force (Tax)'', you can change the current rate, but it is preferable to add another one to keep an history.

![]() You can delete a group or a tax code, but it is not recommended to do it. They can be used in your existing transactions and the removal could cause errors in the system.

You can delete a group or a tax code, but it is not recommended to do it. They can be used in your existing transactions and the removal could cause errors in the system.