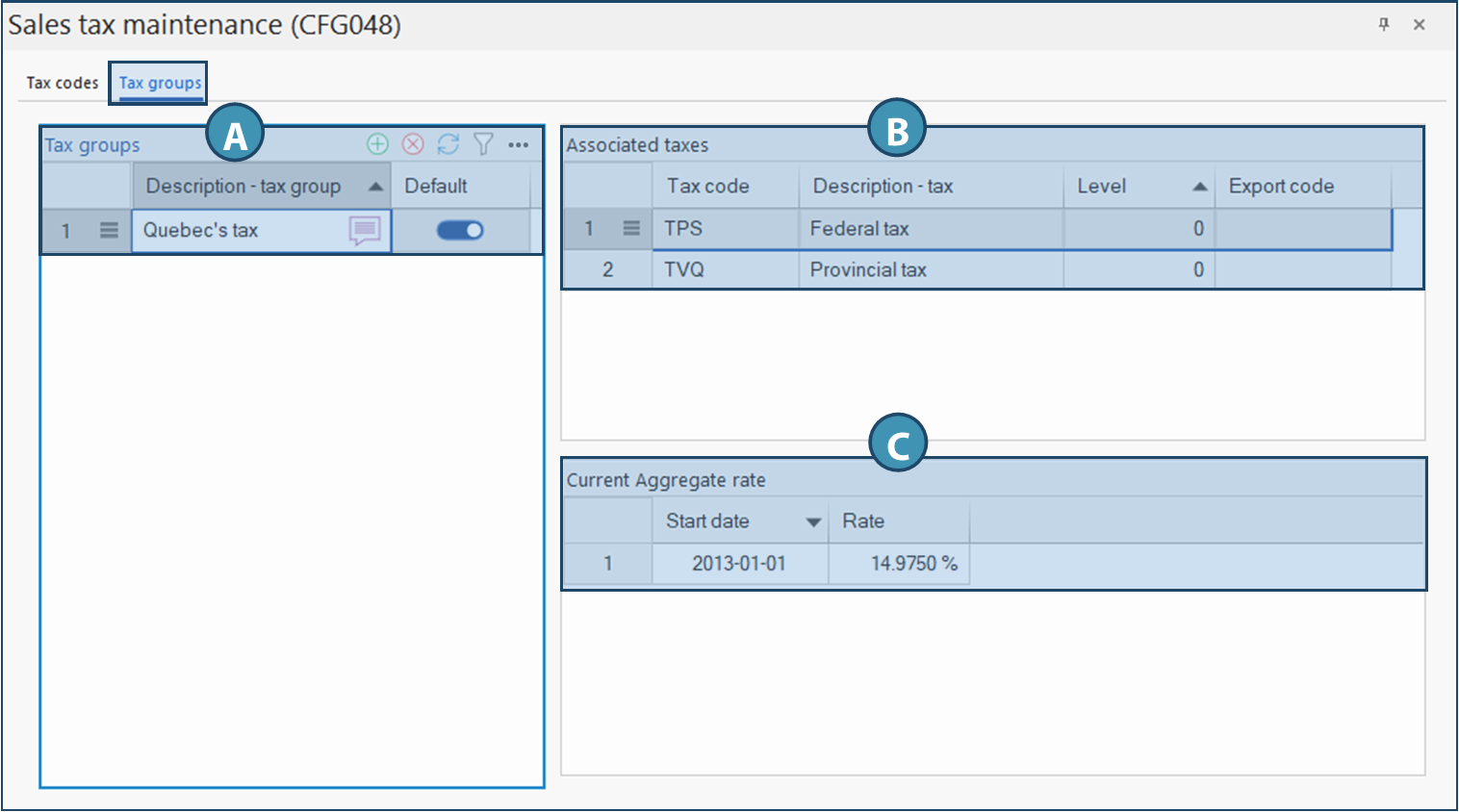

This tab allows you to group several individual taxes under a single name, which can be useful for simplifying the application of taxes according to region or client type. This allows several tax types to be associated with a single group, making them easier to manage and apply to transactions.

A. Tax groups

This table lists the different tax groups created in the system. When a group is selected, the taxes that make it up and the resulting aggregate rate are displayed in the other sections.

Description - tax group : Group name (e.g. Quebec's Tax).

Default: Allows you to set this group as the default for new records. (Switch on or off).

Only one tax group can be defined as the default tax group. Only one tax group can be defined as the default tax group.

B. Associated taxes

This table displays the individual taxes that make up the group selected in the list on the left(A).

Tax code: Abbreviation or identifier of the tax (e.g. GST, QST).

Description : Explicit name of the tax (e.g. Federal tax, Provincial tax).

Level: Tax application order: determines the order in which taxes are applied, if applicable.

The default value is 0, which means that all taxes are calculated directly on the total amount of the transaction, regardless of any other taxes calculated.

•Simple example (level 0) : If you wish to apply GST and QST to the total amount, without any interaction between them, both taxes must be defined with level 0.

•Cascade calculation example (level 0 and 1) : If you need GST to be calculated first on the total amount, then QST on the amount including GST, then set GST to level 0 and QST to level 1. This allows the system to respect the desired order of calculation between the different taxes.

Export code: Code used in exports or external interfaces (often 0 if not used).

C. Current Aggregate rate

Displays the total combined tax rate for the selected group, by period. This section is useful for viewing the actual rate applied in billing. It is not possible to modify the values displayed here, since they are the result of the rates configured for each tax, taking into account the levels entered (order of application).

Start date: Date from which this aggregated rate is in effect.

Rate: Total percentage (here, 14.9750% corresponding to GST + QST).

|

As in many PRIM windows with tables, the menu at the top of each table

As in many PRIM windows with tables, the menu at the top of each table  and the floating menu hovering over the column headers

and the floating menu hovering over the column headers  allow you to use advanced grid features. For more details on these features, please see Advanced features in a grid or table.

allow you to use advanced grid features. For more details on these features, please see Advanced features in a grid or table. Tax codes tab

Tax codes tab Tax groups tab

Tax groups tab